Content

Agencies/departments will determine the budgetary plan for charging the encumbrance and subsequent expenditure when issuing a multi-year agreement. Agencies/departments have discretion as to which fiscal year appropriation to charge; however, the budgetary plan is the key factor in making this determination. An available appropriation represents the amount of the appropriation that can still be obligated or spent within the availability period allow in the Budget Act.

Bill and Jim were extremely helpful keeping us on target and requesting any missing information that we were able to fully onboard in 2 months and begin running parallel systems. This expedited timeline gave us a full month of working with Acumatica in 2020 before using it exclusively in 2021. Do you wish you could get a better picture of your organization’s true financial snapshot at any moment? This is why we allow you to record these obligations at the time they are foreseen, even if the services haven’t yet been rendered or the billing hasn’t taken place.

Similar to Encumbrance Accounting

Encumbrances are created in the accounting system at the account, support account, and object code levels at the time a requisition is approved by the final department approver. When an invoice is processed against the PO, the encumbrance is released at the time of the invoice posting in the accounting system. It is possible that the invoice posting may not release the entire encumbrance due to the vendor billing less than the encumbered amount. Or, only part of the order could be fulfilled and an alternate vendor was used. It is also possible a PO may not be able to be fulfilled by the vendor or the department decided to cancel the order. Unspent encumbrances will roll over to each fiscal year until they are spent or removed. If an encumbrance needs to be removed, please send an email to with the encumbrance amount, document number and justification to remove the encumbrance.

What are financial encumbrances?

Financial encumbrances, called liens, are debts incurred by owners that are lodged against the property. Two common types of liens are mortgage liens and mechanic's liens.

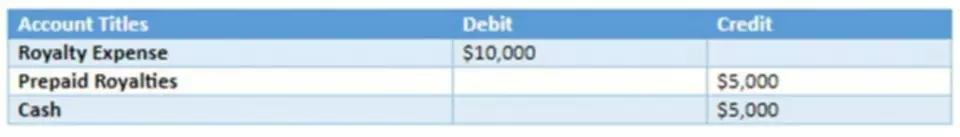

When you need to allot money for a future payment, such as when a purchase order is approved, the encumbrance account is debited. In the future, when you pay that sum off, the encumbrance account is credited. Other examples of encumbrance can include money set aside for payroll, allotted cash for monthly fees such as utilities or rent, and cash that is set aside for taxes or other longer-term fees. It is up to your company to decide which items will be the most helpful for them to track to more accurately predict and track cash flow. When you decide to carry cover encumbrances, check that all journal entries are correctly made and that all the balances you’re bringing forward are correct, since the balances you bring forward cannot be reversed. Internal Ecumbrances represent the commitment of funds generated by travel authorization documents and are coded with the balance type code IE. Contract and Grant Cost Share Encumbrances are created for purchase orders that are cost-share funded and coded with balance type code CE.

Expense

Another form of lien called judgement lien is a legal ruling that gives the right to creditor to have possession of assets of the borrower in case he or she fails to make payments. The number represents a limit; if the company spends more, then it has gone over budget. An important factor in this calculation is encumbered funds, which is where the business ring fences the money and places a restriction on what the cash can be used for. Encumbered funds are most commonly used in government accounting to make sure there’s enough money set aside to meet specific obligations and purposes. Encumbrance journal entries and accounting are also sometimes called commitment accounting.

It is important, from the buyer’s perspective, to be aware of any encumbrances on a property, since these will often transfer to them along with ownership of the property. An easement refers to a party’s right to use or improve portions of another party’s property, or to prevent the owner from using or improving the property in certain ways. For example, a utility company may have the right to run a gas line through a person’s property, or pedestrians might have the right to use a footpath passing through that property. Encumbrance https://www.bookstime.com/ when it comes to real estate, due to its many applications, has many different types. Each type is meant to both protect parties and specify exactly what each claim entails—and is entitled to. Other encumbrances, such aszoning lawsand environmental regulations, do not affect a property’s marketability but do prohibit specific uses for and improvements to the land. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years.

Types of Encumbrances

Amounts obligated for goods or services through contractual obligations should be encumbered according to Texas Attorney General Opinion Numbers , V-1139 ; WW-40 and WW-978 . For purposes of the Binding Encumbrances and Payables Certification, an outstanding encumbrance is defined as a contract, agreement or other action that legally obligates state funds.

- Routable wants to enable you to grow into the future, which is why we have a sophisticated API for any bulk processing.

- However, agencies/departments must meet the deadlines for submitting procurement documents as specified by the DGS.

- The net financial burden represents the portion of the hospital’s expenses that are not covered by program revenues, directly generated by the hospital.

- The creditor can then sell the property to recoup at least a portion of their loan.

- Any encumbrance funds are not part of the actual funds ledger balance, because payments haven’t been processed.

Encumbrance accounting, also known as commitment accounting, tracks anticipated spending to budgeted amounts. The first step encumbers newly entered purchase order line items into the General Ledger to help prevent overspending. After that, you unencumber the line items once they go into an Accounts Payable invoice for payment. Encumbrances are not considered actual expenses and are not included in actual-expense balances.

Looking for other ways to increase your accounting’s accuracy and analytics? Our platform helps you simplify your AP and AR processes, eliminating manual errors and allowing for better tracking of your payments and vendors.

Amounts obligated for goods or services actually rendered or provided to the agency by the end of the reporting period but for which the agency has not yet made payment should be recorded as accounts payable. The purpose of accounting for encumbrances is to prevent the overspending of an appropriation. Encumbrances reserve a portion of an appropriation representing an obligation that has not been paid, what is encumbrance accounting or commitments related to unperformed contracts for goods and services. In Hong Kong, for example, the seller of a property is legally required to inform the real estate agent about any encumbrances against the property in order to avoid any problems later on in the sales process. The real estate agent will provide the buyer with a land search document that will have a list of any encumbrances.

It is also a term used by colleges and universities to describe limitations placed on a student’s account due to late payment, late registration, or other reasons stated by the institution. An encumbrance can prohibit students from registering for classes, affect the release of their transcripts, or delay the reception of their diplomas. Please contact the offices listed below with questions about specific encumbrances or to request liquidation. Encumbrance accounting is not used to account for commitments related to unperformed contracts for construction and services. At year-end, agencies/departments should review encumbrances and liquidate reverting year encumbrances. A title search is research of public records to determine a property’s legal ownership and find out what claims are on the property. A land trust takes ownership or authority over a property at the request of its owner, often for tax and privacy purposes but with possible downsides.

Befriend Your Budget in Dynamics GP with Encumbrance Management – MSDynamicsWorld

Befriend Your Budget in Dynamics GP with Encumbrance Management.

Posted: Mon, 25 Apr 2022 20:46:12 GMT [source]

When the invoice is processed by the Accounts Payable Department, against the Purchase Order, – the encumbrance gets liquidated and the funds are used for payment. If an invoice is sent to the Accounts Payable Department without referencing the correct Purchase Order, the account will be charged twice for the purchase and the encumbrance will need to be liquidated manually. Please avoid this problem, by making sure all invoices have the correct Purchase Order number assigned to them for proper payment.

Leave a Reply